If we assume that the actual labor hours in February add up to 75 and the hourly rate of. 9 per lb.

Variable Overhead Standard Cost And Variances Accountingcoach

Hours Standard Price or Rate 5.

. Divide 120 by 40 giving 3 per hour. Round your answer to 1 decimal place Sharp Company manufactures a product for which the following standards have been set. Compute the standard hours allowed per unit of product.

2 For direct labor a Compute the standard direct labor rate per hour Standard from ACCTG 202 at Brigham Young University Idaho. Do not round. Compute the standard hours allowed for the months production.

Direct materials Direct labor Overhead Units manufactured Exercise 21-10 Direct labor variances LO P3 Standard 5 lbs. POHR times the actual amount of the allocation base used by the specific job. Standard Quantity or Hours 3 feet.

Putting the values we get. 12 per hr. The price basis standard labor rate is the price per hour that is charged to a customer for services rendered.

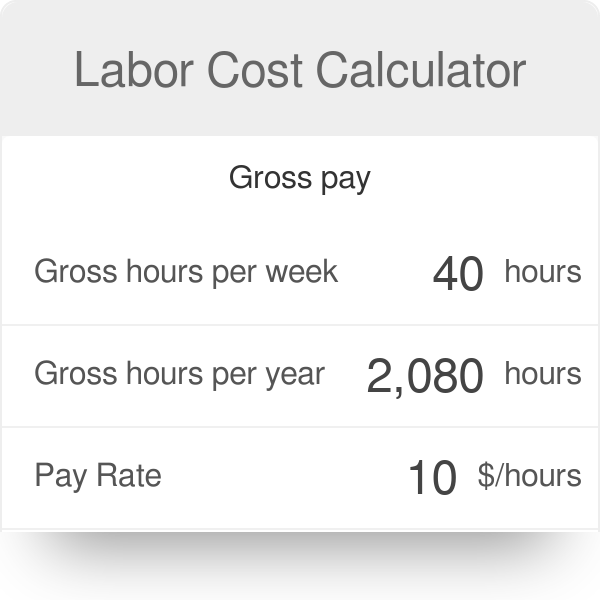

For the calculation of the standard rate per direct labor hour. Basic wage rate employment taxes fringe benefits standard rate per direct labor hour. The first step to calculating the direct labor rate is to determine the total time spent on the production of a product or delivery of a service.

If a three person auditing team. Compute the standard direct labor rate per hour. Add that to the 20 hourly pay and you have 23 per hour in direct labor costs.

16 per hr. Sharp Company manufactures a product for which the following standards have been set. The standard cost of direct labor and the variances for the February 2021 output is computed next.

Calculate the cost per widget. If it takes one person 2 hours. This price is comprised of a standard profit margin as well as.

The formula to calculate the amount of manufacturing overhead to allocate to jobs is.

6 Steps To Calculate Hourly Billing Rate For Architects

Variable Overhead Standard Cost And Variances Accountingcoach

0 Comments